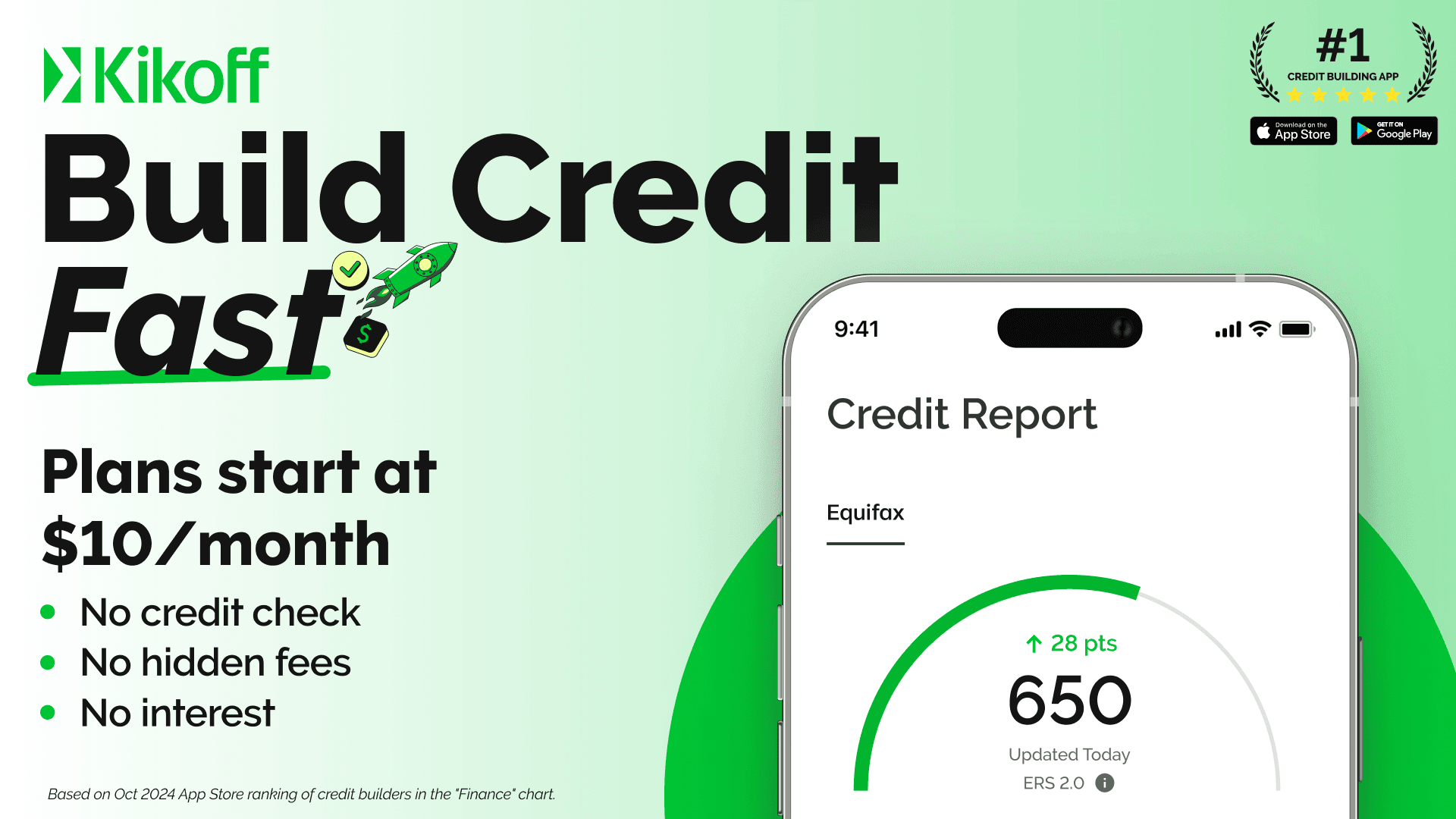

Kikoff is a fintech platform that provides consumers with tools for building and improving credit scores. It’s especially useful for individuals with limited or no credit history. Kikoff’s platform offers simple, affordable products designed to help consumers build credit from the ground up without the high fees or complexities that tend to come with conventional credit-building options.

Kikoff also provides handy resources to help consumers gain financial literacy and develop money management skills.

Our Verdict

| Who Is Kikoff Best For? | Consumers who: – Have limited or no credit history – Have bad credit – Want low-cost tools to build a positive credit profile |

| What We Like About Kikoff | – No credit check – 0% interest – Credit reporting – Affordable – Automatic payments |

| What We Don’t Like About Kikoff | – Can’t use credit line for everyday purchases – Only reports to one credit bureau (Equifax) |

What Does Kikoff Offer?

Kikoff offers a credit account designed to help you build a positive credit profile, whether from the ground up or to improve poor credit.

Features:

- Quick application. You can apply with Kikoff in just minutes. To start, you’ll have to create an account with your email.

- No credit check. You don’t need good credit or any credit history to apply as Kikoff does not require a credit check.

- Line of credit. You’ll have a $750 tradeline specifically for building credit.

- Build good credit. Each on-time payment made can help you build good credit. Your tradeline can also increase your credit utilization ratio, mix up your credit, and add an account that will age over time, all of which can positively impact your credit health.

- Low fee: Kikoff’s Basic plan starts at $10 per month.

Qualifying With Kikoff

It’s easy to apply for Kikoff’s credit account. All you need to do is fill out and submit the online application and provide a source to verify your identification.

There is no credit check required, so you can apply even if you have poor credit or no credit history at all. If approved, you’ll be notified immediately.

Before applying, you’ll first need to create an account, which can be done quickly and easily by providing your email address and creating a password. Once your account is generated, you can log in to your account and apply for Kikoff’s credit account.

How To Apply With Kikoff

To apply for a Kikoff Credit Account, follow these steps:

Step 1. Sign Up

Create an account by providing your personal information, such as your name, email address, and phone number.

Step 2. Verify Your Identity

You’ll need to provide some documentation to help Kikoff verify your identity.

Step 3. Apply For The Credit Account

Complete the online application form with your financial information. No hard credit check is required.

Step 4. Approval And Access To Funds

Once you’re approved, you’ll have a $750 tradeline, which you can use to start building good credit.

What We Like About Kikoff

There are plenty of perks that come with Kikoff’s credit account, including the following:

- No Credit Check. Kikoff will not perform a hard credit inquiry when you apply for a credit line, so it won’t negatively affect your credit score. Plus, there’s no need to have good credit or any credit history to apply.

- No Interest. There is 0% interest charged on balances and no hidden fees for signing up.

- Credit Reporting. Kikoff reports your account activity to Equifax, helping you build credit.

- Affordable. Kikoff’s plans start at just $10, making it an affordable option for consumers.

- Automatic Payments. You won’t have to worry about missing payments thanks to Kikoff’s Autopay feature.

What We Think You Should Watch Out For

While there are several advantages of using Kikoff’s credit account to build good credit, there are a couple of factors to consider before signing up:

- Restricted Use. You can’t use your Kikoff line of credit to make everyday purchases, like gas or groceries. Instead, the credit line is designed specifically for credit-building purposes.

- Only One Credit Bureau Reported To. Kikoff reports only to one credit bureau (Equifax).

Is Kikoff Safe?

Kikoff is dedicated to keeping your data safe. The site will use your personal information only for purposes specified in its Privacy Policy. If you have any concerns about how your data is used, you can contact Kikoff’s Privacy Officer at privacy@kikoff.com.

How Does Kikoff Compare To KOHO And Nyble?

There are a handful of other companies in Canada that offer small credit lines, including KOHO and Nyble. Let’s compare Kikoff to these other tools to help you decide which platform is more suitable for you to build your credit profile:

| Kikoff | KOHO | Nyble | |

| Credit Check Required? | No | No | No |

| Credit Reporting | Yes | Yes | Yes |

| Cost | $10/month | $5 – $10/month | $11.99/month |

| Interest Rate | 0% | 0% | 0% |

| Credit Limit | Up to $750 | Up to $225 | Up to $250 |

| Flexibility | Can only be used to build credit | Can be used for various spending purposes | Can be used for various spending purposes |

Final Thoughts

Kikoff is a great tool that consumers with no credit or low credit scores may find useful to build or improve credit. It’s also suitable for those who are looking for a cost-effective and low-risk way to build good credit. Just keep in mind that you won’t be able to use your Kikoff line of credit to make everyday purchases, and can only use it to build good credit.

Frequently Asked Questions

Is Kikoff a cash advance?

Which credit bureau does Kikoff report to?

How much does Kikoff cost to use?

How much can my credit improve?

1Based on real Kikoff members who made a purchase with the Kikoff Credit Account from and including July 2024 to and including September 2024 with starting scores below 660 and made their first payment. Such members saw an average Equifax ERS 2.0 score increase of 28 points after their first two months of membership. Late payment may negatively impact your credit score. Individual results may vary.