Every year, Canadians discover just how important their credit scores are. Your credit scores are a common factor used by lenders when determining your creditworthiness and can influence your ability to access certain financial tools and products. In fact, healthy credit is one of the many factors major banks and other traditional lenders require for approval for certain products, like mortgages, and vehicle loans.

While your credit is not the only factor that lenders look at for approval, it can affect their decision-making process and even the interest rate they charge you.

Can You Improve Your Credit Scores?

There is no guaranteed way to improve your credit scores, as there’s no single action that can guarantee improvement to your credit scores. Moreover, any action taken to improve credit will not affect all consumers’ credit scores in the same way.

However, there are certain factors that may affect your credit scores. As such, if you’re looking to build better credit, the best thing you can do is to consider these factors and incorporate healthy credit habits into your life.

Ways To Help Improve Your Credit Scores

While no one action can guarantee an increase in your credit scores, the following may help improve your credit scores.

Make Timely Payments

One factor that is taken into consideration when a credit score is calculated is how responsible you are with your debt payments. Paying on time and in full can help you build a positive payment history which may affect your credit scores, so be diligent with your payments. If your credit scores have fallen due to financial mistakes like missed payments, it’s imperative that you make sure these habits change.

Ways To Avoid Missing Payments

- Automatic Payments – Set up automatic payments for loans and credit cards if you have trouble remembering to pay them. For your credit cards, this means setting up an automatic payment for your minimum payment. Remember, if you don’t pay off your credit card balance in full, you’ll be charged interest.

- Change Billing Due Date – Call your credit card provider and ask if you can change your due date to match up with your paycheque or to a time that works better for you.

- Consolidate Debt – If you have too many payments to remember or you can’t afford them all. Consider consolidating your debt, with either a loan or a program.

- Set Up Notifications – This is the easier way to remember to make your payments on time and it’s free. Set up notifications on your phone. If you clear your notifications and then forget, set up multiple notifications.

Lower Your Debt-To-Credit Ratio

This one goes hand-in-hand with making timely payments. Your debt-to-credit ratio is an important contributor to your credit score calculation. A good rule of thumb is to spend less than 30% of your credit limit.

How To Lower Your Debt-To-Credit Ratio?

How do you lower your ratio when using your credit cards is an important part of your financial life?

- Ask For A Limit Increase – Increasing your limit but keeping your spending the same, should help lower your utilization ratio.

- Pay Off Your Card(s) Twice A Month – An even easier way to help lower your utilization ratio is to pay off your credit card balance twice a month. This will help you keep your balance low throughout the month.

Review Your Credit Report For Errors

It’s recommended that you check your credit report at least once every 6 months to a year. However, more frequent monitoring can help you better track your credit and ensure all the information on the report is up-to-date and accurate.

Errors in your credit report can negatively affect your credit scores. If you do notice any errors, report them to the respective credit bureau to have them investigated and rectified. Fixing even the smallest error could have a positive impact on your credit scores.

Types Of Errors To Look For

When checking your credit report, be sure to look for errors in these areas:

- Personal Information – You may find errors in regards to your basic personal information such as your name, birthday, address, and social insurance number.

- Credit Information – When verifying your credit account information, look for inaccurate payment information, duplicate accounts and incorrect account statuses.

- Identity Theft – Be sure to verify that all accounts and credit inquiries are yours. Any accounts, debts or credit inquiries you’re unfamiliar with may be a sign of identity theft.

How To Dispute An Error On Your Credit Report?

| How To Dispute An Error With TransUnion | Learn More |

| How To Dispute An Error With Equifax | Learn More |

Where Can You Check Your Credit Reports?

| Cost | Credit Score | Credit Report | ||

| Free | Yes | Yes | Visit Site | |

| Free | Yes | Yes | Visit Site | |

| Free | Yes | Yes | - |

Apply For A Secured Credit Card

If your credit is poor and you don’t qualify for a regular unsecured credit card, you can apply for a secured card instead. In fact, secured credit cards are often advertised to borrowers who have bad credit. These cards operate the same way a regular credit card does, except, these cards require an upfront security deposit which also serves as the credit limit.

Every payment you make will be reported to the credit bureau(s), which will help you build a positive payment history. Similarly, your credit score can also be negatively impacted if you miss any payments. Moreover, when you open a new account, it can reduce the length of your credit history which may negatively impact your credit scores.

However, if used responsibly, you may be able to switch to a regular unsecured credit card once your credit improves. You’ll also get back your initial safety deposit once you cancel your secured credit card (provided it’s in good standing).

Apply For A Guarantor Loan

Guarantor loans are a good option if you have credit scores so low that you’re having trouble getting approved.

When you apply for a guarantor loan, there is generally no credit check involved for the primary borrower (you) during the application process. Instead, it’s your guarantor’s credit and finances that will be checked.

Your guarantor will need to have good credit and finances in order to be approved. If approved, you can use the guarantor loan to cover your expenses and build credit as your pay back the loan.

Benefits Of Improving Your Credit Scores

If you have fair to good credit, you may be wondering why you should continue to improve your credit. Here are some benefits to improving your credit scores:

- Better Chances of Approval – Credit is one of the many factors lenders use during their loan approval process, so having good credit may help you get approved for loans and other credit products.

- Lower Interest Rates – Like your loan approval, your credit scores can help you qualify for lower interest rates.

- Higher Credit Limits and Larger Loan Amounts – High credit scores indicate that you may be a less risky borrower than someone with poor credit. As such, lender may be more willing to provide you with a loan, given that all other factors are the same.

Other Ways To Help Improve Your Credit Scores

Improving your credit scores can take time and can often be difficult to stay on track and keep motivated. To help you stay focused and make the process just a little bit easier for you, consider the following steps:

Don’t Close Old Accounts

Often people want to cancel their credit cards when trying to manage their finances better and improve their credit scores. However, in some cases, it can be beneficial to keep your credit cards open and active, especially if there’s no annual fee attached to them.

Keeping your credit card account open and active (active enough that your creditor doesn’t cancel it for being inactive) may help your credit. It’s better to keep old credit accounts open as closing them can reduce the average age of your credit accounts, which is a common factor used in the calculation of your credit scores. Cancelling a credit card, especially one that you’ve had open for a long time, could have a negative effect on your scores.

Don’t Apply For Too Many New Credit Accounts

Whether you’re applying for a car loan, personal loan, or credit card, the creditors associated with each will want to know what your credit health is like. This entails pulling your credit report. Whenever this happens, a “hard inquiry” is noted on your credit report. Doing so may cause your credit scores to drop, particularly if you have multiple hard inquiries within a short time frame.

Moreover, multiple hard inquiries may signal to any potential lender that you’re frequently applying and being denied for new credit. This, in turn, might make them question whether or not you have a significant debt problem. If other lenders aren’t approving your applications, why should they?

Create A Budget And Start Saving

Learning how to budget and save is an important part of your financial health, whether your credit is good or bad. However, it becomes especially important when you’re trying to rebuild your credit. Creating a budget and cutting down on costs should come first. Every penny you don’t spend is a penny you can put into your savings account, then use to pay your debts.

What Can Cause Your Credit Scores To Drop?

There are a number of factors that can affect your credit scores.While no one action will affect a consumer’s credit scores the same way, these are some common factors that could negatively impact it:

- Missed, late, or short payments

- Financial delinquencies (bankruptcies, consumer proposals, accounts in collections, etc.)

- Activating and/or cancelling too many credit accounts within a short period of time.

- Errors in your credit report that go undisputed

- Recent “hard inquiries” performed by lenders and other organizations when considering you for new credit.

What Is A Credit Report?

A credit report is one big profile that contains information on your credit-related accounts (that lenders have reported to the credit bureaus) and your personal information over a predetermined number of years. If you open an account for a new credit product or make a payment to an existing one, it typically gets recorded in your report. However, it’s important to note that not all credit accounts and transactions get recorded as some lenders and creditors do not report the data to one or both Canadian credit bureaus.

How Long Does Information Stay On Your Credit Report?

A record of most transactions (payments, withdrawals, etc.), including cancelled accounts, inquiries, and other instances remains on file for a certain number of years. The exact number depends on the type of information reported. Generally, more serious instances, such as delinquencies (bankruptcies, consumer proposals, accounts put in collections, etc.) may remain on your credit report for longer.

What Qualifies As A Good Credit Score?

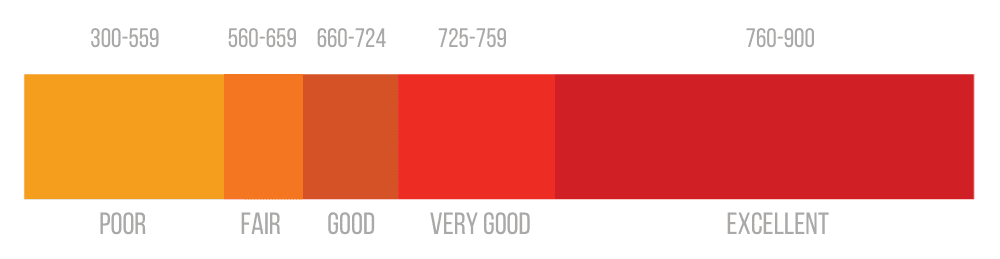

A credit score is a three-digit number, ranging from 300-900. The higher the credit score the more likely the borrower is to make their payments on time. According to TransUnion, one of Canada’s two main credit reporting agencies (Equifax is the second) a credit score of 650 or more is the ideal point where lenders, such as banks and other traditional financial institutions, will consider you a low borrowing risk. And, of course, being a low-risk borrower can open up all sorts of financial avenues for you. Once you’ve reached the credit score range between 750 – 900, your credit is considered excellent.

How To Improve Credit Score FAQs

How to improve my credit score in 30 days?

How to improve my credit score fast?

Can I erase my bad credit history?

Will paying off a loan help my credit score?

Do minimum payments help my credit score?

Bottom Line

If you’re interested in finding the right credit improvement product or service to meet your needs, Loans Canada can help. Whether you’re looking for the best secured credit card or are struggling to manage your debt levels, we have the options you need.