Canadians start their day with a quick stop for a freshly brewed coffee and Timbits. If that sounds like your routine, the Tims® Mastercard offers a tasty way to get rewarded for your purchases. Packed with strong earn rates where you spend the most each month, this card turns everything from your morning coffee to weekly gas fill-ups into more rewards toward your Tims favourites.

The rewards rate on Tim Hortons purchases rapidly accumulates points for frequent patrons, effectively converting regular visits into future savings. However, the reward potential in other categories is less competitive than flat-rate cash back cards. While alternatives offer higher bonuses and lower costs without annual fees, this card is great for dedicated Tim Hortons fans.

Our Verdict: Tims® Mastercard

| Best for | Frequent Tim Hortons visitors who want to maximize rewards |

| What we like about the card | – No annual fee – Tims loyalty program integration – Smooth digital experience |

| What we don’t like about the card | – Decreased rewards on secured card – Redemption minimums & limitations – Points expire 12 months after earning them |

Overview: Tim Hortons Credit Cards 2026

| Tims® Mastercard | Secured Tims® Mastercard | |

| Annual Fee | $0 annual fee | $0 annual fee |

| Earn Rate | – 15x points per $1: At Tim Hortons locations in Canada (with Tims Rewards scan) – 5x Points per $1: On groceries, gas, EV charging, transit, taxis, and rideshares – 1x Point per $2: On all other purchases | – 12x points per $1: At Tim Hortons locations in Canada (with Tims Rewards scan) – 2x Points per $1: On groceries, gas, EV charging, transit, taxis, and rideshares – 1x Point per $4: On all other purchases |

| Interest Rate | – Interest on purchases: 20.99% – 26.99% (QC: 20.99% – 24.99%) – Interest on cash advances: 22.99% – 27.99% (QC: 22.99% – 25.99%) | – Interest on purchases: 20.99% – 26.99% (QC: 20.99% – 24.99%) – Interest on cash advances: 22.99% – 27.99% (QC: 22.99% – 25.99%) |

| Perks | – Extended warranty up to $1,000 per incident – Purchase protection for 90 days up to $1,000 per incident – Mastercard zero liability | – Extended warranty up to $1,000 per incident – Purchase protection for 90 days up to $1,000 per incident – Mastercard zero liability |

What We Like About The Tim Hortons Credit Cards

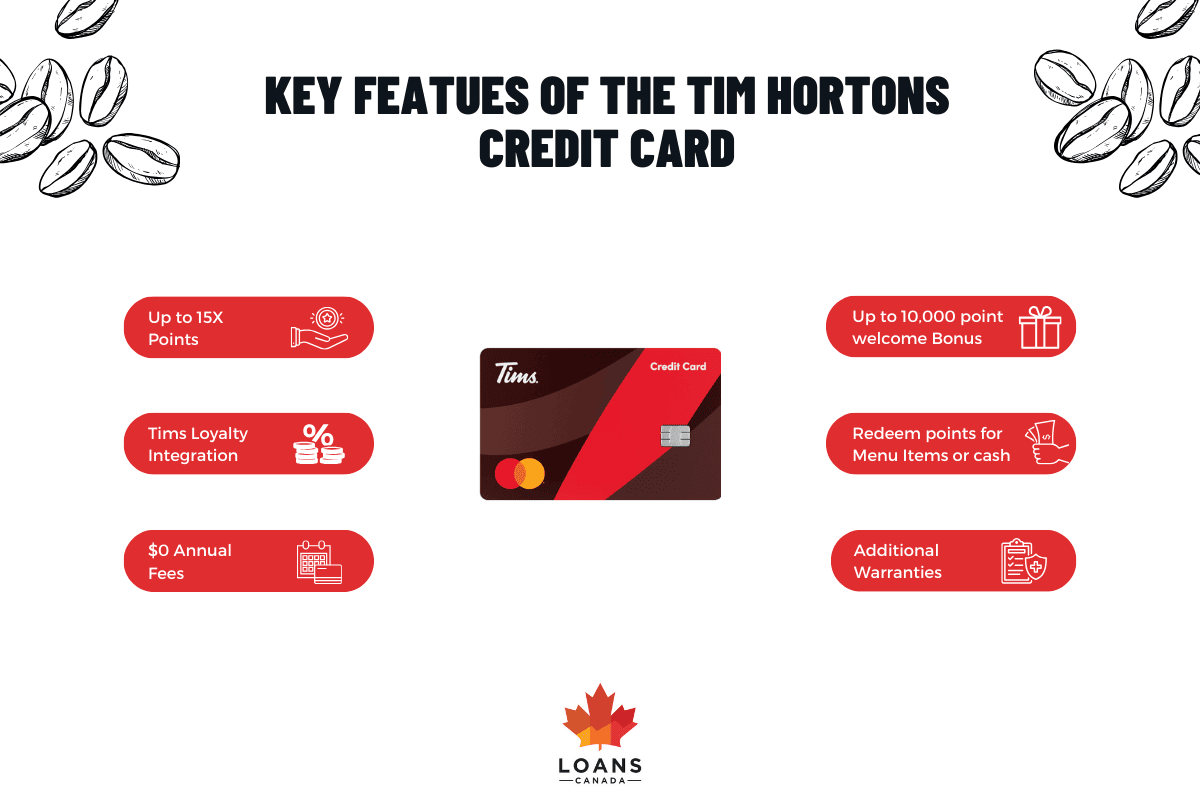

- No Annual Fee: The Tims® Mastercard eliminates annual fees, making it cost-effective for frequent use. Its rewards and zero annual cost make the card a budget-friendly alternative to premium cards with high fees.

- Tims Loyalty Program Integration: This card integrates with the Tim Rewards program, allowing you to earn points from both card purchases and the loyalty program, maximizing your rewards. You can manage your card and points with a smooth digital experience.

What We Think You Should Watch Out For With The Tim Hortons Credit Card

- Redemption Minimums & Limitations: The card limits statement credit redemption to up to 6% (up to $45 once per week).

- Points Expire: Tims Rewards points expire 12 calendar months after they are earned. You risk expiration if you don’t use the points fast enough. This differs from most programs that only expire after +12 months of account inactivity. But this is better than McDonald’s and Starbucks, whose points expire six months from the month you earned them.

How To Apply For The Tim Hortons Credit Card

You can apply to the Tim Hortons app found on the App Store and Google Play Store. Approvals only require a few pieces of personal information. You receive either an instant approval decision or requests for additional details.

You will get approved for a secured credit card or a regular credit card based on your credit score. If you get approved for the secured version, you must provide a minimum of $50 in your account as security funds.

Eligibility Requirements For The Tims® Mastercard

- 18+ years of age (19+ in some provinces)

- Canadian citizen or permanent resident

- 700+ credit score is required for Tims® Mastercard

Eligibility Requirements For The Secured Tims® Mastercard

Requirements for the Secured Tims® Mastercard vary slightly from the Tims® Mastercard.

- No credit score is required for Secured Tims® Mastercard

- A $50 minimum security deposit is required

How Do Tims Rewards Work?

The Tims® Mastercard is a hybrid rewards card. While you earn points on spending, they can be redeemed for food items or statement credits. You can accumulate rewards up to 300,000 points at a time, and points expire 12 months after they were earned. These points can be redeemed and tracked from the Tims app in the App Store or Google Play.

How To Redeem Tims Rewards & What Can You Redeem For?

Option A: In-Restaurant Menu Items

Points can be redeemed for free coffee, donuts, sandwiches, and more at participating Canadian Tim Hortons locations. This is an easy, convenient way to enjoy Tims food/drinks for free. The number of points needed depends on the menu item chosen. Keep in mind that you can earn up to 15 points per dollar spent at Tim Hortons

| Redemption Options | Required Points |

| – Classic Donuts – Specialty Donuts – Hashbrowns – Cookies | 300 points |

| – Coffee or Tea – Dream Donuts – Bagels – Baked Goods | 400 points |

| – Hot Chocolate – French Vanilla – Iced Coffee – Potato Wedges | 600 points |

| – Real Fruit Quenchers – Cold Brew – Classic Iced Capp – 10-Pack Timbits – Yogurt – Frozen Beverages – Espresso Drinks | 800 points |

| – Breakfast Sandwiches – Soups | 1,100 points |

| – Farmer’s Wrap – BELT – Lunch Sandwiches – Chili | 1,300 points |

| – Loaded Bowls – Wraps | 1,800 points |

Option B: Statement Credits

Points can be used as statement credits for customers who prefer financial redemption. You can redeem points for up to 6% back in statement credits. You can get up to $45 in statements credits every week. Statement credits apply to eligible existing purchases customers made on their card each billing cycle.

Redeeming statement credits for Tim Hortons purchases value your points at 6%, a very high earn rate. However, other categories see a reduced earn rate of up to 2%.

How Many Points Can You Earn Per Month?

| Monthly Spending | Monthly Points | |

| Tims Coffee Runs (15x points) | $100 | 1,500 points |

| Points at the Gas Pump (5x points) | $100 | 500 points |

| Grocery Shopping Rewards (5x points) | $400 | 2,000 points |

| Commuting and Ridesharing Benefits (5x points) | $80 | 400 points |

By concentrating your regular expenses like gas, groceries, commuting, and Tim Hortons visits on the card, you can easily earn over 4,400 points or $17.6 in Tims statement credits. Otherwise, this strategy could reward you with a free box of Timbits weekly by smartly directing your everyday spending toward high-value rewards.

Top Tim Hortons Credit Card Alternatives

| Credit Card | Annual Fee | Earn Rate |

| Neo Mastercard | $0 | Up to 4%¹ |

| Tangerine Money-Back Credit Card | $0 | 0.5% – 2% |

Neo Mastercard

Neo Mastercard is a cash back credit card with no annual fee. It offers 1% on gas and groceries, and up to 15% cashback at over 10,000 Neo partners across Canada. Your earn rate jumps to up to 4% on gas and groceries & up to 1% on everything else¹ when you open a Neo Everyday Account.

Get guaranteed* instant approval and immediate access to a virtual card. Plus, you could qualify for a credit limit increase in as little as 3 months*.

Neo also offers a secured version of the credit card, the Secured Neo Mastercard. Another great option for consumers who are looking to help build their credit history.

Tangerine Money-Back Card

The no-fee Tangerine Money-Back Card edges out the Tim Hortons Credit Card for flexible spending with 2% cash-back rates on customizable categories. Though the Tims Card offers a higher 6% earn for Tims purchases, the Tangerine Card provides a better all-around value between its intro bonus and unlimited 2% earnings on customizable categories.

Looking for the best credit card options?

Bottom Line

The Tims® Mastercard is ideal for loyal Tims customers, turning daily coffee runs into rewards. It offers high bonus rates on Tim Hortons, gas, and transit purchases, allowing for quick point accumulation. The card’s appeal lies in its no annual fee, generous 10,000-point welcome bonus, integration with the loyalty program, and user-friendly mobile experience. Ultimately, the Tims® Mastercard creates a symbiotic relationship; the more you swipe for double-doubles, the more they save for the next purchase.

Tims® Mastercard FAQs

How to redeem Tim Hortons rewards?

How to apply for a Tim Hortons credit card?

Who is Tims® Financial?

¹Minimum balance in a Neo Everyday account required to earn the highest rate. Cashback earn subject to monthly maximum spend limits. Cashback may be limited and varies by perks, offer, and partner. There may be monthly limits for boosted cashback offers.

* Terms & conditions apply. See the application for complete details.