Somewhere along the line, a business will need money to start, grow, or change, it’s a natural part of a business’ life. Unfortunately, it is common for business owners to run into financing problems. The good news is, loan rejection is often attributable to a little mistake or lack of consideration in the application process. Often, rejection is not because your business is a perceived bad investment to lenders. By educating yourself on common business loan application mistakes, you can avoid them on your next application for a better chance at approval.

Check out these small business loan myths.

The Top Errors Made on Business Loan Applications

Many people think if they have a steady income, good credit, and are responsible with payments, they can get a loan with no problems. Individuals with all these characteristics may be surprised when they are not approved for a loan they applied for, either personal or business. The fact of the matter is, there are little details to consider during that application process that could make or break your approval.

The common mistakes businesses make on loan applications are discussed below, as well as how to avoid making these errors.

No Business Plan

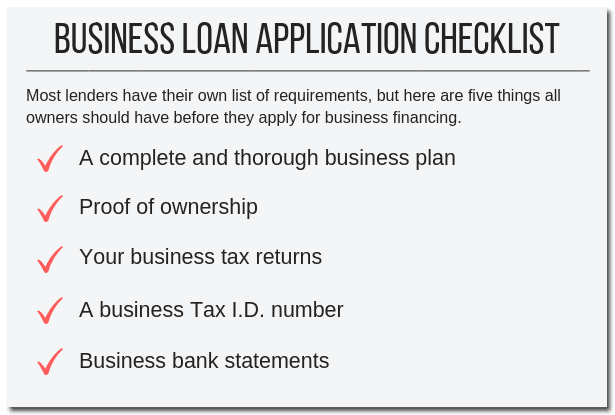

Businesses don’t run themselves. In order for a business to be successful, there need to be goals, plans, and objectives in place. A business plan is the perfect way to communicate how you will operate your business for success. Lenders like it when applicants are prepared with a business plan because it shows they are committed. Not only will it help you obtain financing, but it could also help you run your business better and identify what you need to work on.

Part of your business plan should include up to date, accurate financial statements. Financial statements are crucial for risk assessment processes of lenders. If the information is inaccurate, it could cost you loan approval. A common mistake small businesses make is boosting figures to ensure financing is obtained. Banks can verify the amounts on your financial statements by using third-party verifications. This is why it’s best, to be honest!

Can you get a business loan based solely on an idea? Click here to find out.

Applying for Wrong Product or Unclear Financing Reason

There are tons of financial products on the market for businesses. Applying for a financial product that is not ideal for your purposes can result in rejection. To find the best loan for your business, start by clearly defining your financing needs, then look for financial products that match.

In addition, be very clear in your application about what you intend to use the funds for. Providing quotes, estimates, and a budget of what you’ll use the money for is a great way to show the lender how you’ll use the money. The lender wants to have confidence that you’ll create a positive impact on your business with the funding.

Business loans vs. merchant cash advances, check this out.

False or Incorrect Information

Providing false information, either unknowingly or knowingly, can result in a declined application. Incorrect information could communicate many things to the lender, all of which will reflect on you poorly. Before submitting your application, do a double check to ensure everything is correct.

Poor Personal or Business Credit

Credit scores and reports are almost always considered by lenders in the approval process. If your credit or your business’ credit is poor, it could result in your application’s rejection. Be sure to check both personal and business credit reports before applying and do what you can to clean it up.

How does your personal credit affect a business loan application? Find out here.

Major Business Changes

Businesses in the process of financial changes, reorganization or any other big alterations tend to be unstable. Lenders prefer to extend financing to companies that are established and in a comfortable state. If your company is going through major changes, it’s best to hold off on applying for financing until all the changes are complete and the chaos has settled.

Too Much Existing Debt

The more debt you take on, the fewer lenders will want to extend credit to you. This is because you are more likely to default on a loan when you’re juggling multiple debts. If you have outstanding debt, pay down what you can before trying to apply for new credit.

How to Find Out What Your Business Credit Score Is

It is not a well-known fact that businesses have credit scores, just like individuals do. Although, the layout and information within a business credit report are much different than an individual’s credit report. A business credit report contains the following major sections: business information, score summary, score details, industry summary, and company details. All of these categories paint a detailed picture of a business’ activity and creditworthiness.

Unlike individual credit reports, business credit reports are accessible to the general public. Businesses are not covered by consumer protection regulations which means that their information can be visible to anyone. Obtain yours today to understand what lenders see when you apply for a loan.

For even more information about business credit scores, click here.

How to Deal with Business Debt

If you have existing business debt, it is wise to deal with it before you apply for new funding. As mentioned, lenders don’t like businesses with a lot of existing debt because there is a higher risk they will default. To deal with your business debt, follow the guideline below.

- Organize. It’s challenging to devise a plan for your debt if you aren’t organized. The very first thing you should do is organize all your business’ paperwork and debt information.

- List Your Debt. To create a plan to tackle your debt, you’ll need to know how much you have exactly. Listing the payment amounts and withdrawal dates is a good idea too. Finally, consider which debts are more pressing than others. For example, high-interest debt should be paid off first since it is the most expensive.

- Plan. Now that you understand the big picture, it’s time to create a plan to get out of debt. You may be able to handle the situation on your own or you may need to get help, either is okay. The important thing to focus on is your business operations and how they affect the path toward becoming debt free. Debt is overwhelming for anyone going through the struggle, try not to get discouraged!

- Research. Part of planning will be doing research on debt solutions. Keep an open mind and consider both lenders and financial products as a part of your research.

Finding The Righ Business Loan

Whether you’re applying for a business loan for the first time or reapplying, it is helpful to understand what lenders consider to be the most important. But it’s helpful to know what types of mistakes are common among business loan applicants, this way you can avoid as many of them as possible. If you’re looking for a business loan and don’t know where to start, Loans Canada is your one-stop shop for all your business funding needs.