It has been brought to our attention that some of our clients have been receiving text messages from “Loans Canada” stating that they have been approved for an “instant loan” of $5000. We want to make it very clear that this is a scam.

Loans Canada does not send out loan approval text messages to anyone. The only type of message you will receive from Loans Canada is to let you know that our system was able to match you with a lender after you have submitted an application on our site.

Check out this article for more information about known scammers posing as Loans Canada.

How Does The Scam Work?

Text message scammers will often masquerade as a creditable source such as banks, phone providers, government entities, or even family members. The text message sent will typically invite you to click on a link, phone number (as in our case) or email. Once clicked, you will be prompted to provide your personal and banking information on a separate page. This page is often created to look like the company it is trying to mimic, where they will ask you to provide information like your username, password, credit card number, debit card number, or PINs. Sometimes, the link may even install spyware which can allow the scammers to steal your personal and banking information.

How To Spot A Loan Scam

Unfortunately, loan scams are all too prevalent. The only way to prevent more Canadians from falling victim to them is to open a conversation about these types of scams and provide as much information as possible.

Here are the most common signs that you are dealing with a loan scam:

- The promise of a guaranteed approval

- 0% interest rates

- Lenders with no contact information

- Being pressured into making a decision before you’re ready

- The feeling that it’s too good to be true

- Being asked to transfer money to the lender, before you get your loan, via a prepaid credit card, Western Union transfer, bitcoin, gift cards, or Interac e-transfer.

- Unofficial email address, no legitimate company or lender will contact consumers with a Gmail address

- Being contacted out of the blue with a loan approval message

- Text messages – no legitimate financial institution will contact you via text message for sensitive information.

- Emails – no legitimate financial institution will contact you via email for sensitive information.

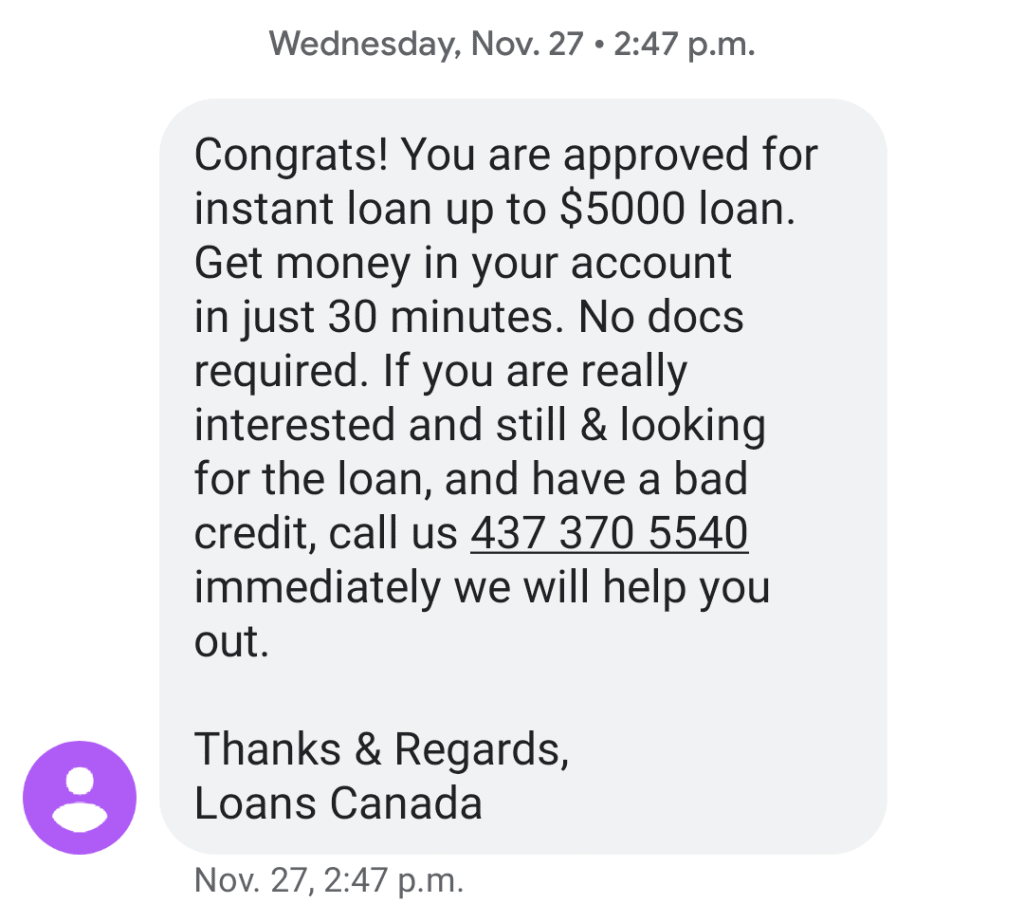

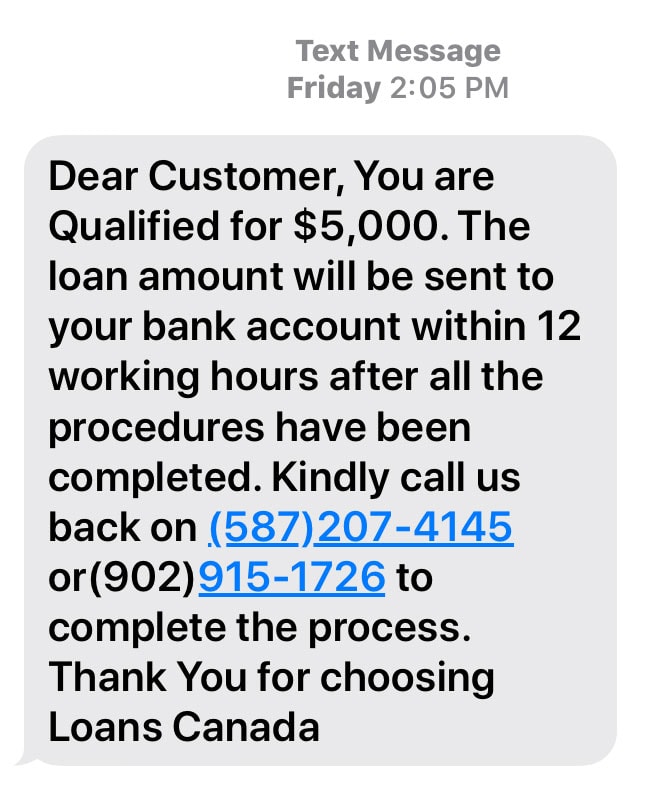

Example Loan Scam Text Messages

This is a recent example of a text message scam sent to one of our clients. How do we know it’s a scam? Let’s check the signs!

- The message was unsolicited.

- A quick search of the number will prove that the sender is in fact not from Loans Canada.

- Guaranteed approval – no documents required.

- It is a text message

- The offer sounds too good to be true.

If you notice one of the warning signs, it’s best to contact the company through direct channels to confirm the legitimacy of the text.

Loans Canada Will Never…

- Ask for any of the following information via a text message…

- Social insurance number (SIN)*

- Banking information*

- Access to your online banking (card number, username, password)

- Health card, driver’s license, or passport information.

- Send emails, texts, or phone calls telling you’ve been approved for a loan

- Ask for upfront fees or any money for any reason.

*It’s important to point out that a legitimate lender may ask for this information as part of their due diligence process. We understand that this can be confusing, just remember that they will not ask for your SIN or bank account information via text message. And absolutely no legitimate lender, loan comparison site, or service provider, will ever ask for access to your online banking.

Loans Canada May Ask…

Keep in mind, depending on the type of request you submit through Loans Canada, we may ask you for the following information via our request form, not via text message.

- Reason for needing a loan

- Loan amount required

- For details regarding your financial health such as…

- Your credit score range

- Your income

- Your monthly expenses

- Your debt load

- For basic personal information such as…

- Name

- Address

- Phone number

- Email address

- Job

Loans Canada is a comparison platform that helps individuals find the lenders that are best suited for their needs in their area. The only way that Loans Canada asks for information from our clients is through a request on our website.

How To Avoid Being Scammed?

Scammers are often after sensitive personal information or direct access to your bank account that can allow them to commit fraud. In order to avoid being scammed, here are a few things you should never do.

- Do not respond to unknown texts. Period. Not even if it is to curse them or ask them questions to see if they are legitimate. The best thing to do is to ignore them and report them.

- Never give out sensitive information to unexpected requests.

- Never give out sensitive information via text or email. No legitimate business, bank or the government will ever ask for your personal or financial information via text or email.

- Never give out sensitive information if you’re not 100% sure that the person you are dealing with is legitimate. Take your time to investigate by doing some online research or calling your provider directly to determine the person’s credibility. Moreover, think of the warning signs of a scammer: is the person threatening or in a hurry? If so, they are likely a scammer.

- Don’t click on links from someone you don’t know or trust.

What Should You Do If You’ve Been Scammed?

If you or anyone you know feels like they have been contacted by a fake lender or is the victim of a loan scam, contact the authorities right away. If you have provided your banking information to a fake lender, contact your bank right away.

You can also contact the Canadian Anti-fraud Centre to report the scam. You can call the number 1-888-495-8501 from Monday to Friday between 10 am and 4:45 pm.